79

One of the financing options for expansion or modernization of a

rental or leasing company’s fleet is CredFrota program, offered by Caixa

Econômica Federal, has begun 2015 offering several innovations.

CredFrota is a line of credit designed to help renew and expand

the fleets at micro, small, medium and large companies. “With the

revitalization of the product, which began in October last year, several

improvements have been made to serve the rental and lease segment,”

says Jorge Pedro de Lima Filho, the national head of vehicles at Caixa.

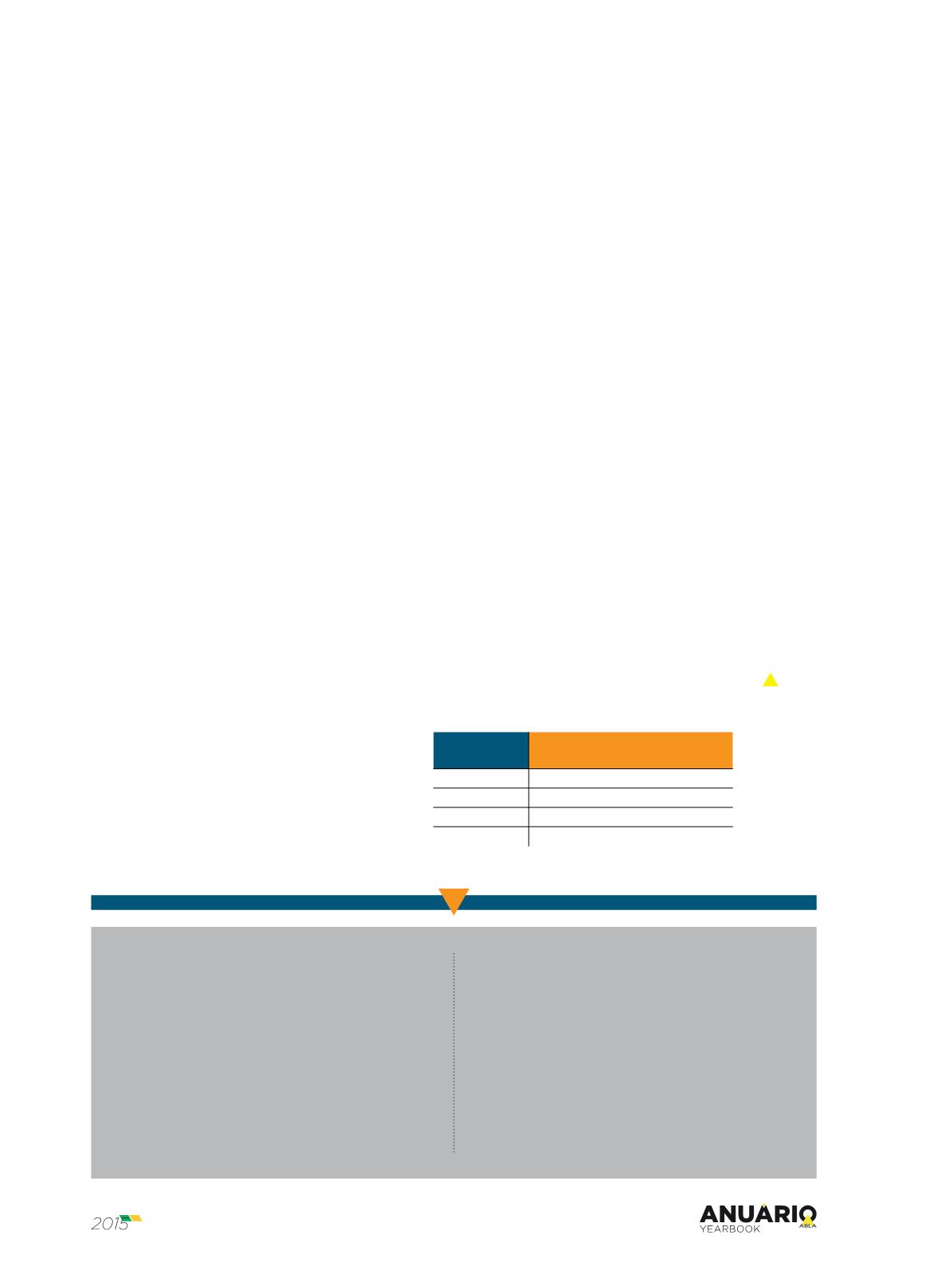

The new features are: extended payback term from 18 to 24 months;

the release of guarantees according to the contract’s amortization; the

extension of the range of eligible items, which now covers the following

guarantees: newmotor vehicles, Brazilian and imported, in the light, cargo,

van and utility categories; and the creation of a minimum percentage of

depreciation in accordance with the financing term (see chart *).

According to Lima Filho, it is estimated that the volume of credit to

be granted to fleet managers in 2015 has grown by 157% on last year

to R$ 1 billion. The car rental and leasing companies are users of the

program. Last year the segment accounted for approximately 10% of

total finance. However, the bank expects these improvements to double

this figure in 2015.

Lima Filho says one advantage of CredFrota over other funding

programs is its Constant Amortization System (SAC) which allows a

company to adapt payments to billing flow, since the product allows the

payment of part of the finance in the last installment, as is often the case

in the sale of vehicles that are renewing the fleet.

Another difference is that this line of credit has parameters to

address the particularities of each sector. “For vehicle rental and leasing

companies, there is in addition to SAC a simplified procedure of risk, rate

and term analysis,” says Lima Filho.

He says, “ When comparing identical situations for amortization of

90% between SAC and Price, for example, we come to a saving in total

funding, via Credfrota of about 5%, but the gain is much higher than

that.””After all, rental and leasing companies can tailor the contract’s

amortization percentage, which can be composed of more than one

guarantee for the flow of vehicle sales. That is, there is no impact on the

company’s working capital at times when it has no fleet sales revenues,”

says Lima Filho.

Lima Filho also says some customers say financial control has been

made easier because it reduces the need for extra credit operations to

capitalize the company at times of fleet maintenance or market changes.

Regarding the conditions for financing via CredFrota, Lima Filho says

that the payback terms for the rental and leasing segment is up to 24

months. Rates vary according to the period, the amortization percentage,

the vehicle’s year, and the customer’s relationship with Caixa.

Made to measure

CredFrota is offered by Caixa Econômica Federal to finance vehicles for fleet

owners, with special conditions for each sector

Prazo /Payback

(Meses/Months)

Percentual mínimo de amortização

Minimum amortization percentage

1 - 12

20%

13 - 15

25%

16 - 18

30%

19 - 24

40%

Prazos e percentuais mínimos

de amortização do CredFrota

Payback terms and minimum

amortization percentages in CredFrota

Divulgação

Jorge Pedro Lima Filho explica como o CredFrota é lavado

ao conhecimento dos agentes financeiros: “O CredFrota faz

parte do portfólio de produtos da Caixa destinados à Pessoa

Jurídica, disponível em todas as agências Caixa que possuem

relacionamento PJ. Estas, por sua vez, divulgam junto aos

clientes e parceiros comerciais da Caixa as modificações e

vantagens do produto.Parceiros comerciais, como a ABLA,

auxiliam nesta divulgação, além de contribuírem para a

melhoria constante da operação com sugestões que buscam

atender às aspirações de crescimento do setor”.

Disclosure

Jorge Pedro Lima Filho explains how CredFrota is

promoted to financial agents: “CredFrota is part of the

portfolio that Caixa holds for corporate clients, and is available

at all Caixa branches that have corporate relations office.

These, in turn, disclose to customers and business partners

of Caixa’s the changes and advantages of the product.

Commercial partners, such as the ABLA, assist in this

disclosure and contribute to the continuous improvement of

the operation with suggestions that seek to serve the sector’s

growth targets.”